The world of short-term rentals is a dynamic and rapidly evolving one, and it is no wonder that it sparks significant discussions at conferences like the New Hampshire Housing and Economy Conference last week in Manchester. Vacation rentals, thanks in part to platforms like Airbnb and VRBO, have gained an increasingly prominent online presence. In fact, renting an “Airbnb” has become synonymous with booking a vacation rental. In this blog post, we delve deeper into the world of short-term rentals in New Hampshire, exploring their impact on housing and the economy, and providing clarity on what defines a short-term rental.

The world of short-term rentals is a dynamic and rapidly evolving one, and it is no wonder that it sparks significant discussions at conferences like the New Hampshire Housing and Economy Conference last week in Manchester. Vacation rentals, thanks in part to platforms like Airbnb and VRBO, have gained an increasingly prominent online presence. In fact, renting an “Airbnb” has become synonymous with booking a vacation rental. In this blog post, we delve deeper into the world of short-term rentals in New Hampshire, exploring their impact on housing and the economy, and providing clarity on what defines a short-term rental.

The debate surrounding the impact of vacation rentals on workforce and affordable housing is a critical one. Fortunately, a report published by New Hampshire Housing, in collaboration with data from AirDNA, provides some insights. The findings indicate that vacation rentals are not the villain some claim them to be in terms of rising rents. Part of this may be due to the fact that many of these properties were already classified as seasonal, recreational, or occasional-use properties.

.png?width=767&height=284&name=Copy%20of%20Untitled%20(2).png)

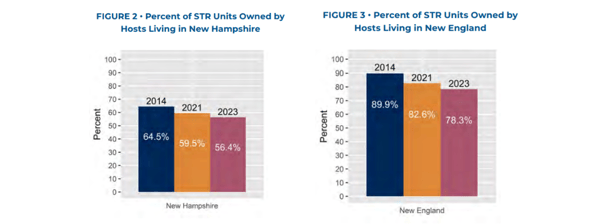

When we looked into the economic aspect, the statistics are enlightening. A sizable portion, 46%, of short-term rentals in New Hampshire are owned by hosts residing in the same county. Digging deeper, approximately 56% are owned by New Hampshire-based hosts, and a substantial 78% are owned by hosts from New England. This means while they are second homes and thus rentable, it is on a part-term basis as they are accessible and used by the owners on a regular basis. This also suggests that a substantial portion of the income generated from short-term rentals circulates within the local community, which can have a positive economic impact. These rentals also contribute to increased tourism revenue including lodging tax dollars in the area, further bolstering the local economy.

There seems to be some confusion about the definition of a short-term rental. With the rapid evolution of the vacation rental industry, the lines between short-term and long-term rentals and other lodging options have become increasingly blurred. In this blog post, we try to help better define a short-term rental, highlighting the key features that set it apart from long-term and other alternatives.

The Ever-Evolving Definition

The definition of a short-term rental is not set in stone and is subject to change as the industry progresses. However, there are a few characteristics that are typically associated with short-term rentals, providing some clarity amid the confusion. Here are our thoughts and would be interested in your opinion on this in the comments

- Furnished Accommodations

One consistent feature of short-term rentals is that they are always furnished. This means that guests can expect to find at least one bed or sleeping arrangement, a fully functional bathroom, and a well-equipped kitchen. Additionally, amenities such as Wi-Fi and television are often provided to enhance the guest experience. Of course, there are exceptions to this rule such as unique rentals like treehouses and houseboats, where providing all these features might be more challenging but remains a hallmark of the industry.

- Lodging Tax

Another key characteristic of short-term rentals is the lodging tax that renters are required to pay. This tax is typically collected by hosts/agencies or platforms and remitted to local authorities. It helps fund assorted services and initiatives in the area and is an important distinction from long-term rentals, which typically do not involve such taxes.

- Pricing Flexibility

Short-term rentals are known for their pricing fluctuations based on seasonality and demand. Rates may increase during peak vacation seasons, holidays, or special events. This pricing flexibility allows hosts to adjust their rates to maximize revenue, while guests may need to plan their stays more strategically to secure the best deals. Since COVID, guests book closer to the arrival date to try and secure discounts for properties that are still available. In contrast, long-term rentals tend to have a more stable, flat monthly rate.

- Individual Ownership and Uniqueness

Short-term rentals typically have individual owners which distinguishes them from hotels and motels. This individual ownership adds a personal touch to the guest experience and may result in a property that is more unique and diverse. Additionally, short-term rentals may serve as second homes and, in some cases, lifestyle assets, where the owner's use is relevant and may change over time. This aligns them more with long-term rentals and, in most states, places them under real estate law, trust accounting, and local real estate commission jurisdiction.

The Importance of Clarity

Understanding the definition of a short-term rental is crucial for everyone with a stake in housing including towns, owners, and guests in today's housing and lodging landscape. Clarity in terminology helps set proper expectations and ensures a smoother booking experience. Here is why it matters:

- Expectations

When guests book a short-term rental, they anticipate finding a furnished space with specific amenities. Clear definitions help manage these expectations, reducing the likelihood of disappointments during the stay.

- Value

This is dependent on the audience that is considering the value.

-

-

Owners – An owner bought this second home for a multitude of reasons. It is most likely one of their biggest assets and is one of the safest ways to build wealth. But that depends on the owners' financial and long-term objectives. It is crucial that the property is well maintained and that is done by local services.

-

Guests – Guests booking a vacation rental property get a very different experience than through other lodging options- it is often less expensive per guest and provides community living and a “lifestyle” vacation.

-

Cities or Towns – The tourist dollars that are brought in locally add additional revenue to the town’s coffers, often funding necessary additions or upgrades to local services like schools, emergency departments, and parks and recreation. Also, since second homeowners are usually hundreds of miles away, they will rely on local contractors to help them maintain their homes which build local businesses.

-

- Regulatory Compliance

Owners need to be aware of the distinctions between short-term and long-term rentals to comply with local regulations, especially concerning building codes, noise ordinances, lodging taxes, permits, and a multitude of other safety-associated issues

Conclusion

In a world where vacation rentals are becoming increasingly diverse and unique, defining what constitutes a short-term rental is essential. Although the industry's definition may evolve over time, certain characteristics like furnished accommodations, lodging taxes, and ownership remain key features that help distinguish short-term rentals from their long-term counterparts and other lodging options.

Short-term rentals are complex and that requires more professionalism. Smart second homeowners will work with a professional short-term rental agency to help them market the property effectively, provide superior operational elements during a guest's stay, and ensure that regulatory requirements are met.

Barefoot Technologies is a full-service property management solution for professional property managers. We provide the technology that allows the property manager to manage all of the aspects of the short-term vacation rental business. From marketing and guest management, housekeeping and work orders, and true trust accounting, Barefoot is the one-stop shop to keep you running. For more information contact ed.ulmer@barefoot.com.